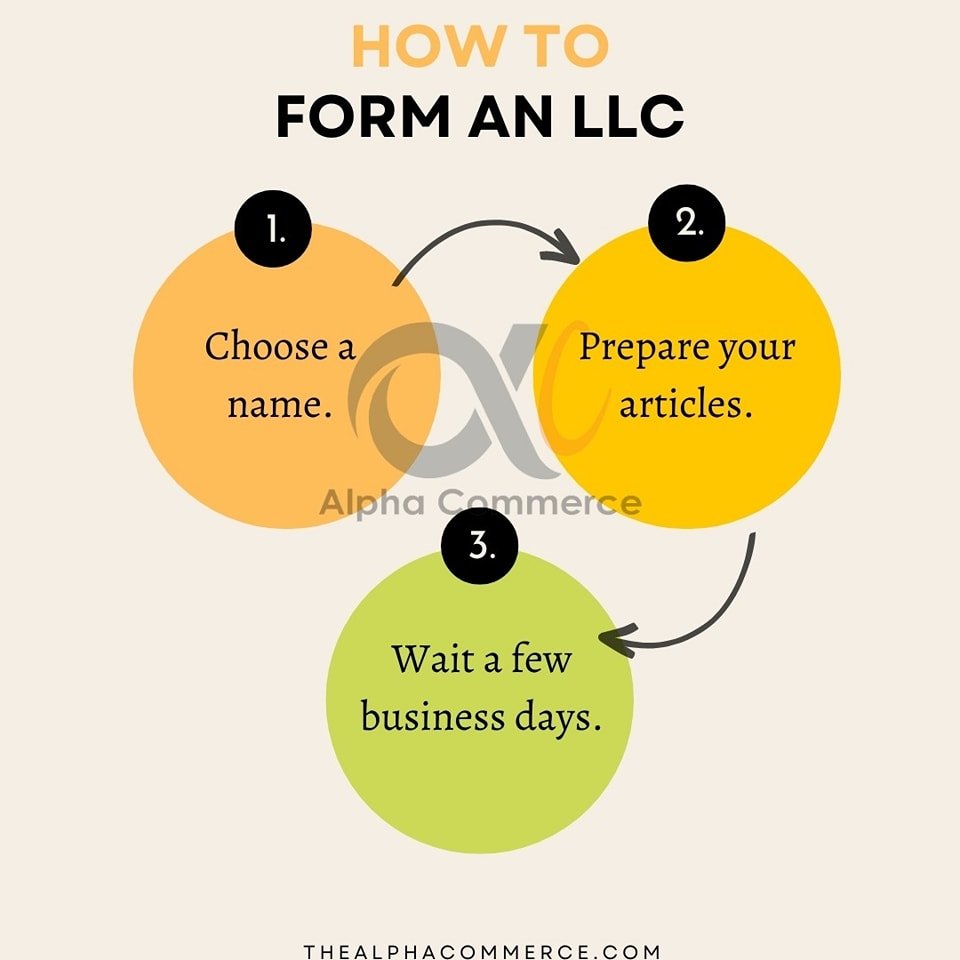

How to form an LLC?

You have to do the following steps to form an LLC:

- Choose a name for your LLC.

- Prepare your Articles of Organization, Certificate of Organization or Formation. File by mail or file for LLC online with the Secretary of State and pay the filing fee.

- Wait a few business days to get your LLC approved.

These are the main steps to form an LLC. There are a few more steps like Operating Agreement, Federal Tax ID Number (EIN), and Annual Report.

How an LLC Protects Your Personal Assets?

Set up a Legal Entity for your business so your personal assets are not at a risk of being used for covering business debts and liabilities.

We are often told to think big and move fast. These are important steps to success. But in the beginning, moving too fast can be dangerous. Many new entrepreneurs jump into their business very quickly, they overlook important details, making costly mistakes. These mistakes can be put their businesses in a long-term danger.

The first newbie mistake

The top mistake that people usually make is not setting up a Legal Entity for their business. If you do not create it, your business is just a Sole proprietorship (single owner) and a Partnership (2 or more owners) in the perspective of law, it can also expose your personal assets. If a Sole proprietorship or a Partnership is sued, your personal assets are at risk of being used for the settlement of debts and liabilities.

So the most common Legal Entities that people form are LLCs and Corporations.

Before getting forward, let’s discuss what a Legal Entity actually is.

Legal Entity

A Legal Entity is almost the same as a Business Entity. Let’s use both the terms to make it more easily understandable to you.

According to the law, a Business Entity is a “Legal Person”, you and I are “Natural Persons.” A Natural Peron is a living, human being that exists independently and makes his own decisions. A Legal Person, on the other hand, is only functional through the actions of Natural Persons acting on his behalf. A Legal Person is, by law, a separate person from its owners.

Protective Wall

“A protective wall” between your assets and the assets of the business.. The purpose of LLC is to keep your personal assets safe in case your business is sued.

A Natural person is a regular human being like you and I. A Legal Person is a Corporation like Microsoft or IBM or it can also be a local store. Even though a Business Entity is not an actual living person but it shares many rights and responsibilities like a Natural Person.

Things that a Business Entity can do

- It can make money

- Can own properties

- Can make contracts and agreements

- Can open bank accounts

- Can sue and be sued

- Can pay taxes

It actually means, the only things that a Legal Entity cannot do is vote for an election or do the household chores.Through a Legal Entity, you can create a business organization that can interact with customers, clients and more.

Protecting Your Assets

Most important of all, a Legal Entity can safeguard your personal assets. In case of a lawsuit, creditors can only go after your assets of Legal Entity not your personal assets.

Personal Liability Protection

Personal Liablity Protection is the number one reason that make people to go for setting up a Business Entity. Not creating a Business Entity means allowing the law to view your business as a Sole Proprietorship or a Partnership. It cannot keep your asets safe. Keep it in mind, if any of these is sued, your personal assets are also at a risk of being used in place of your debts and liabilities. But, if you create a Business Entity and then your business is sued, then the only thing at risk is your Business Entity, not your personal assets. It can create a “Protective wall” between your business and your personal assets. The main types of Business Entities that people usually form are Corporations and Limited Liabilty Companies (LLCs).

You can get more information on these by clicking here: Sole Proprietorship vs. LLC vs. Corporation.